|

Matters Pecuniary ... credit cards, banking, debt management, |

No, your funds at a fintech are not 100% safe just because the fintech partners with an FDIC-insured bank

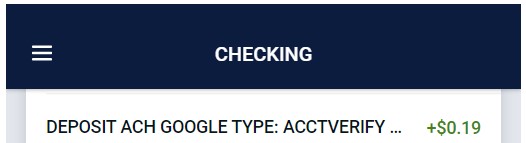

Fintech, neobank, challenger bank, financial technology company. These are all terms that you may have heard or read in reference to a company that offers banking services, but is not legally classified as a bank. More importantly, these fintechs (which we’ll refer to the collective as) are usually not insured by the Federal Deposit Insurance Corporation (FDIC). The FDIC’s deposit insurance program safeguards up to $250,000 of your funds in the event that your bank fails. Not surprisingly, some consumers are nervous and apprehensive about keeping funds on deposit with companies that aren’t insured by the …