|

Matters Pecuniary ... credit cards, banking, debt management, |

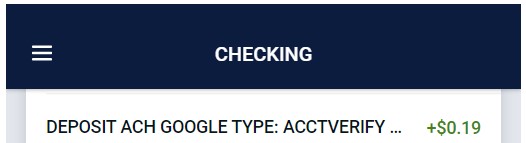

New ACCTVERIFY label used in account verification process

If you see the description “ACCTVERIFY” on a deposit or withdrawal in your account, this means that the party that initiated the transaction is attempting to verify that you are the account owner or have access to the account.

You might already be familiar with a very similar version of this process if you’ve ever attempted to link a bank account to another company. For example, you might want to transfer funds between two accounts that you hold at two different financial institutions. When you request to link the accounts, the bank that you’re submitting the request to may deposit one or more small amounts into the account that you’re trying to link to. These are known as trial deposits, test deposits, micro-deposits, and micro-entries. The purpose of these deposits is to confirm that you have access to the account that you’ll be transferring funds from.

The “ACCTVERIFY” label that you’ll now see for these transactions is due to a new rule enacted by Nacha (formerly National Automated Clearinghouse Association). The initiative is aimed at helping financial institutions and customers easily identify attempts to verify accounts.

Many companies, like Google, PNC, and Schwab, have already adapted to the new rule and utilize it when verifying bank accounts. Nacha is requesting that anyone initiating micro-entries use the “ACCTVERIFY” in the Company Entry Description field beginning on Beginning March 17, 2023.

Nacha defines a micro-entry as “a credit or debit entry used by an originator for the purpose of verifying a receiver’s account or an individual’s access to an account.” A credit micro-entry must be less than $1 and the offsetting debit of the micro-entry must be done on the same day.