|

Matters Pecuniary ... credit cards, banking, debt management, |

Wells Fargo missing direct deposit issue resolved

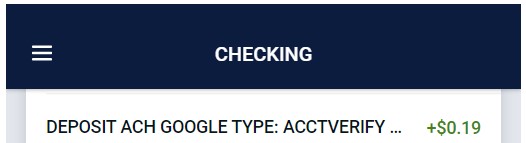

Wells Fargo has restored customers’ access to their direct deposits that went missing. The issue for some customers started on Friday morning when their direct deposits disappeared. In my case, a direct deposit that was pending on Thursday had disappeared on Friday. The direct deposit was listed in my transaction ledger again on Friday. But, that was only momentarily. The direct deposit reappeared again that day and was still in my account on Saturday afternoon. But, by then, Wells Fargo was displaying a new message in the customer portal, which led me to believe that some …